Cross-Chain Swap

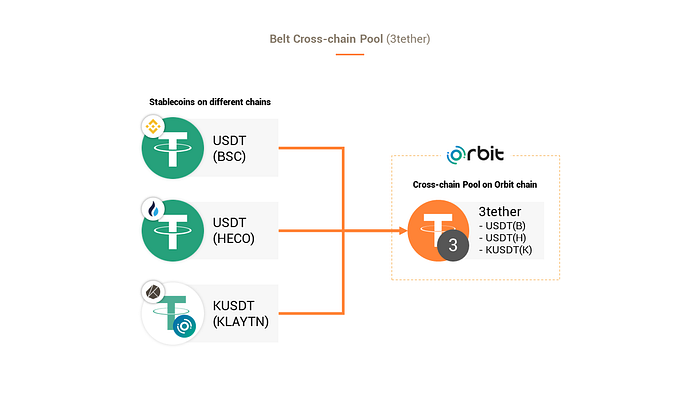

As we announced previously and briefly explained in our Q4 Development Plans, for our upcoming major update to Belt Finance, v3, we are adding a cross-chain stableswap consisting of a pool of 3 stablecoins on 3 different chains

USDT on BSC

USDT on HECO

KUSDT on Klaytn

As the actual cross-chain bridging happens through stablecoin swaps, users will be able to easily move their assets from chain to chain with low IL and slippage, and without going to centralized exchanges. To accomplish this, we are utilizing Orbit Chain and its Orbit Bridge, a decentralized cross-chain bridging protocol, to facilitate the cross-chain swap aspect. Swaps happen on Orbit Chain with our Belt Router contract on each chain and our StableSwap, SwapReceiver contracts on Orbit Chain handling the different processes and LP creation necessary to make smooth cross-chain stableswaps on Orbit Chain possible.

Why Belt’s cross-chain swap is necessary

The future is going cross-chain. This has been evident for some time, and especially recently, side-chains, L1s, and L2s have been exploding with users, liquidity, and new DeFi protocols. This will continue to be the case.

There is a problem that has been arising with this, however — the difficulty in getting your assets to and from these different chains.

Users have always had the option of going through different exchanges. This is fairly complex and time-consuming. Users would send their token to exchange, swap it for a different token multiple times, and then withdraw it to a different exchange, swap it again, and then withdraw to their wallet on a different chain. This is a headache… It also has the barriers of increasing KYC mandates and high withdrawal fees.

Users have had a different option of going through different bridges, but from our own experience, most bridges have had the problems of low liquidity, low choice of what tokens are available to swap, lack of decentralization, security risks, and crazy wait times of up to a few days.

There are no really intuitive ways of doing cross-chain swaps.

How Belt fixes existing cross-chain swap problems

Belt Finance is here to fix these huge issues of going cross-chain. Firstly, we are utilizing the most secure, limitless bridging infrastructure available, Orbit Chain. With an impeccable security record, validator-based decentralization, proven reliability, and outstanding functionality, Orbit Chain was the perfect foundation for us to build our cross-chain swap.

Wave goodbye to insane wait times for cross-chain bridging and swaps as your transactions will happen in a matter of minutes.

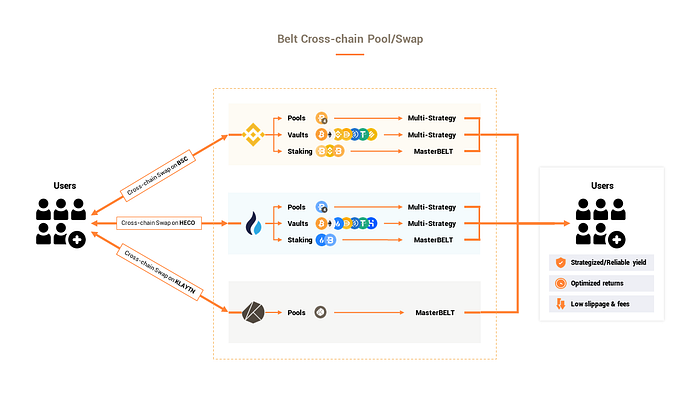

This Belt cross-chain swap router also makes it possible to connect to existing liquidity-based DEX’s to make it possible for users to essentially swap any token to any other token on any of the connected chains (BSC, HECO, Klaytn, and potentially many others). This is where we believe Belt Finance can find its place as infrastructure to DeFi as a whole.

We can connect Belt’s cross-chain stableswap to any DEX on connected chains so that users will be able to trade any token on Klaytn to any token on BSC or HECO and vice versa.

This would be a much easier and efficient, comprehensive cross-chain solution than is currently available and make it far easier for users on other networks to access protocols on different chains for swaps and farming.

All users will have to do to go cross-chain choose any token on the chain they’re going from and choose any token they’re going to. No more multi-step, multi-TX, multi-fee confusions.

To begin with, we will be connecting PancakeSwap on BSC, MDEX on HECO, and KLAYswap on Klaytn to create combined liquidity of over $7B together with Belt’s cross-chain swap as a hub and conduit of liquidity.

We’re making a cross-chain world with Belt in the middle.

Another point of note is that Ozys, the company behind Belt Finance and Orbit Chain, is also the creator of the biggest DeFi protocols on Klaytn. The most notable of these is KLAYswap, an AMM DEX that has 100,000 unique users. Most of these users are Korean and have their DeFi experience shaped by, and limited to KLAYswap. Connecting to KLAYswap through Belt’s stableswap will open the gates for Klaytn users to access these new chains and likewise have other users of BSC and HECO experience DeFi on Klaytn.

Expansion Potential

This is only the beginning of Belt’s cross-chain swap. While we are starting with BSC, HECO, and Klaytn, we will actively be expanding to other chains. The way Belt’s cross-chain swap is designed makes it possible to connect to a multitude of other chains and the top AMMs in those chains.

We are doing this step-by-step to ensure that the cross-chain swap grows smoothly with high liquidity, trading volume, and users.

The next expansions are likely to be Polygon and Ethereum. Announcements regarding any expansion will be made through our official channels.

Benefits to BELT Holders

Connecting liquidity and users across multiple chains will make Belt’s cross-chain swap a crucial piece of DeFi infrastructure in these chains and will subsequently invite high volume, utilization, and liquidity into our own protocol.

As BELT buyback is based partially on swap volume, the accumulating trading fees with every cross-chain swap done will increase buyback volume and aid in upward pressure for the BELT token itself.

As we expand to more assets and more chains, subsequent usage will only increase the volume of BELT buybacks.

Belt Router specifications:

The Belt Router contract has the following functionalities:

Handle crossChain request: crossChain()

Sends token bridging requests to Orbit BridgeOrbit Bridge. (CrossChain swap / CrossChainSwap + DestChainSwap)

2. Handle swap request: swap()

Can handle token swaps on specific AMMs (FromChainSwap)

3. Handle swapAndCrossChain request: swapAndCrossChain()

Sends bridge request after a token swap on an AMM in the From chain, and then sends a request to an AMM in the Destination chain for another swap after bridging. (FromChainSwap + CrossChainSwap / FromChainSwap + CrossChainSwap + DestChainSwap)

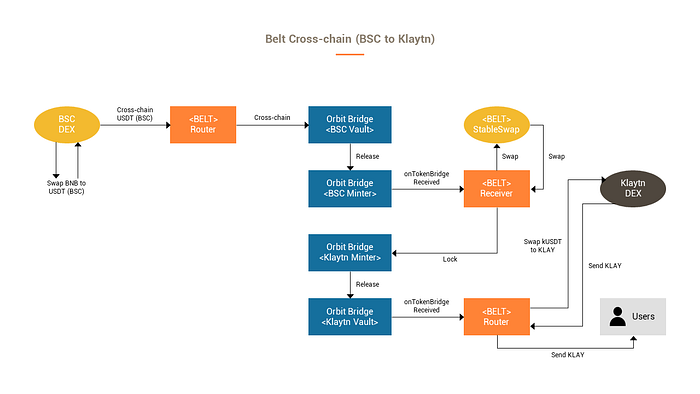

Below is a breakdown of what Belt’s cross-chain swap liquidity on PancakeSwap and KLAYswap would look like going from BNB on BSC to KLAY on Klaytn.

This is a diagram showing the process of going from BNB (on BSC) to KLAY (on Klaytn) utilizing existing AMMs for the initial and final swaps.

How this would work contract/process wise

The key advantage to cross-chain integration with Belt is that a full-cross-chain swap solution can be created with simple integration. There is no need to integrate multiple times for From and Destination chains as Belt Finance can handle this part.

Just like on BSC/HECO Belt’s stableswap, these cross-chain stableswaps (in between swaps on DEX’s on BSC/HECO/Klaytn) would have low slippage and low IL.

Example Transaction Breakdown) Swap BNB (BSC) to KLAY (Klaytn)

(PancakeSwap (or other AMM on BSC)- BSC) swap BNB to USDT (BSC)

USDT (BSC) on BELT’s cross-chain stable pool is bridged to OUSDT on Orbit Chain (Belt Router→ Orbit Bridge)

swap OUSDT(Orbit) to OUSDT(Orbit) (within StableSwap-BELT LP )

bridge OUSDT(Orbit) to KUSDT (Klaytn) (Bridge→ Belt Router)

swap kUSDT- KLAY (KLAYswap — Klaytn)

Possible Tx Reverting Cases:

If Swap 1 fails on the From Chain (i.e. BSC) → the user is returned BNB (BSC)

If Swap 3 fails within Orbit Chain→ the user is returned USDT (BSC)

If Swap 5 fails on the Destination chain (i.e. Klaytn) → the user is returned KUSDT (Klaytn)

Time & Slippage issues

Because cross-chain swaps require token bridging, they require more time than on-chain swaps. Below is an approximation of the time it takes for cross-chain transactions based on the block confirmation count of Orbit Chain.

<Bridging Process Specifications>

klaytnConfirmCount: 10 blocks, -> approx. 10s

bscConfirmCount: 15 blocks -> approx. 45s

hecoConfirmCount: 20 blocks, -> approx. 60s

BSC to HECO requires 45 + 60 = approx. 105s

Orbit Chain Overview

Orbit Chain is a multi-asset hub blockchain that stores, transfers, and verifies information and assets on various public blockchains through decentralized Inter Blockchain Communication (IBC). Currently, Orbit Chain supports more than 14 public chains, including Bitcoin, Ethereum, Binance Smart Chain, Huobi ECO Chain, Polygon, Ripple, Klaytn, ICON, and Celo.

Orbit Chain has built a notable reputation for itself in the past eight months since its launch, having bridged more than $13B worth of assets in more than 360,000 transactions with 50,000+ unique wallets across other top chains including Ethereum, BSC, Polygon, Klaytn, ICON, and Ripple.

Belt will be utilizing Orbit Chain’s cross-chain connectivity and vault/minter system to create LP in and conduct swaps through Orbit Chain.

Ozys, the team behind Orbit Chain, is a company spearheading blockchain development in South Korea, working tirelessly to create unity in the fragmented and dissociated blockchain world. Working under the ethos of “Connecting the Unconnected,” Ozys’ projects utilize cutting-edge technologies to bridge different ecosystems together. Ozys is a member of the Klaytn Governance Council alongside multinational businesses and organizations, including Binance, Huobi, MakerDAO, LG Electronics, and Kakao.

\

Last updated